Six Tips on What to Do after Your Small Business Receives a Paycheck Protection Program (PPP) Loan

The Paycheck Protection Program (PPP), part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, has led to the Small Business Administration (SBA) processing over 3.8 million loans for businesses who would otherwise be in danger of collapse because of repercussions associated with the coronavirus.¹

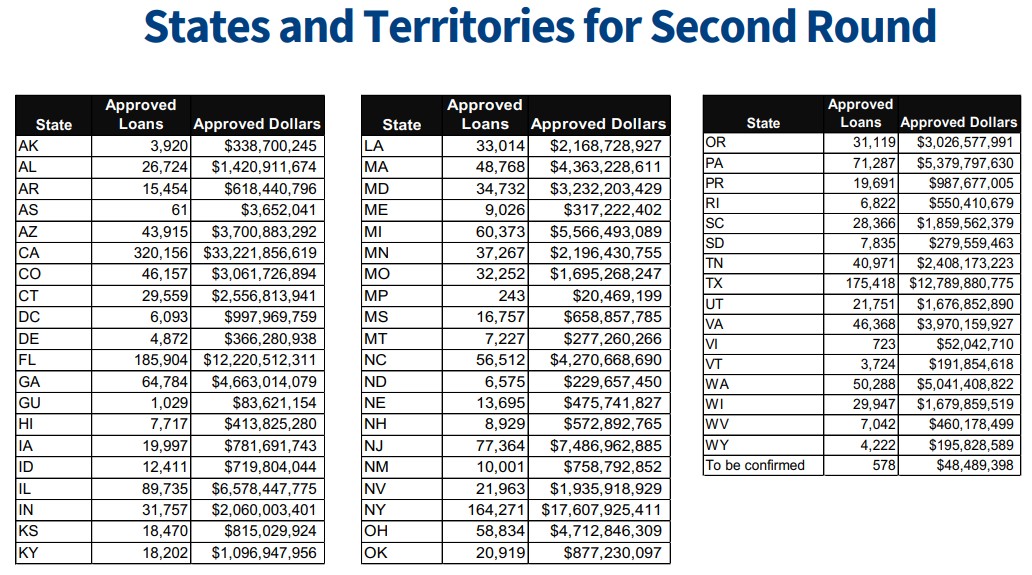

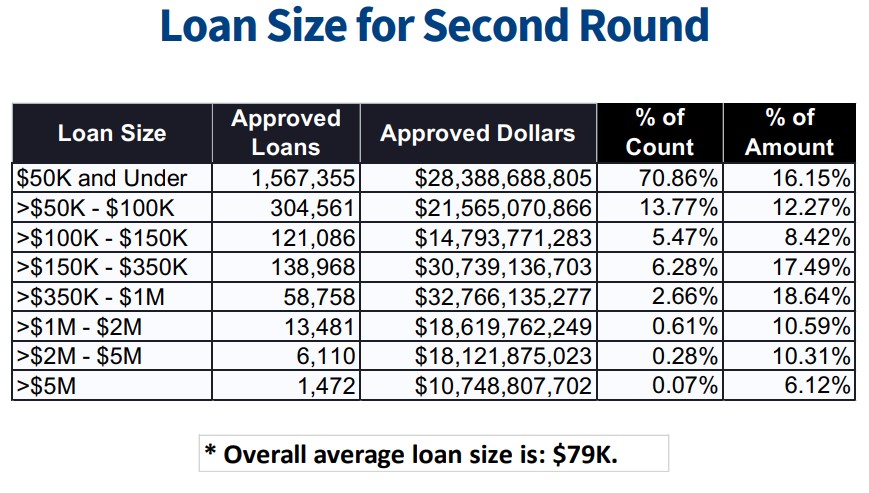

The SBA recently released data on the second round of PPP funding, which includes approvals from April 27 - May 1.² Here's the breakdown by state and loan size:

Images via SBA.gov

It remains to be seen if there will be a third round of PPP funding. However, if you are one of the small business owners who received one of these loans, there are some important things to keep in mind.

1. Know the forgiveness rules

The very first thing you must do when receiving a PPP loan is to ensure you completely understand the rules for forgiveness. This loan is here as a lifeline, and you don't want it to turn into business-sinking debt.

The SBA has said it will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.3

"The loan will be fully forgiven if the funds are used for payroll costs, interest on mortgages, rent, and utilities (due to likely high subscription, at least 75% of the forgiven amount must have been used for payroll)," the Administration said. "Loan payments will also be deferred for six months. No collateral or personal guarantees are required. Neither the government nor lenders will charge small businesses any fees. Forgiveness is based on the employer maintaining or quickly rehiring employees and maintaining salary levels. Forgiveness will be reduced if full-time headcount declines, or if salaries and wages decrease."

2. Use a separate bank account

It's a good idea to keep your PPP loan money in an account that is separate from your other business funds. The loan should not be mixed in with regular revenue and cash flow. This will not only help you keep better track of how revenue and cash flow are occurring naturally, but it will keep you from making withdrawals from loan money that may impact your loan's forgiveness.

3. Consider what it means for the loan before laying off employees

The main reason that the PPP exists is to protect businesses and their employees as part of a larger stimulus to the economy. If you furlough or lay off employees, you may not be using the loan as it is intended, and therefore, may suffer the repercussions for that.

However, if you have used the loan to continue to pay employees for eight weeks and you still need to lay employees off or furlough them, you should still be able to have your loan forgiven, and these employees would be eligible to claim unemployment benefits.

4. Track everything carefully

Just as keeping your PPP money in a separate account will help you stay organized with regard to the loan, you should be tracking every expense, withdrawal, and use of that money thoroughly. This will further help you keep it separate from other parts of the business that don't apply to the PPP, and you will have the necessary documentation to show how you have used the loan.

5. Consider paying employees even if they're not working

Depending on the situation you find yourself in and the nature of your business, it may be worth considering using your PPP loan to pay employees even if they can't currently work.

Small Business expert Jeffrey Scheer, an attorney from Bond, Schoeneck & King, noted in a Syracuse.com Facebook Q&A, "There are a lot of businesses that may be closed but are continuing to pay their employees, even if their employees are home. It may sound silly, but it does give you an opportunity to hire back your employees and pay them, even though they may be ... on the bench, as we say. Consider even bringing people back to have them on call, ready to work again when you are able to reopen your business.” 4

Many businesses will soon be re-opening, even with strict new guidelines in place, so temporarily paying employees while they're not working could help keep them around and ready to get back to work when the time comes.

6. Prepare to be audited

You should go ahead and expect to be audited when it comes to how you have used your PPP funds. It may not happen, but Treasury Secretary Steven Mnuchin has already said that any businesses receiving loans above $2 million will get a full audit.5 It's possible that these audits could happen even to smaller loans once all is said and done. Either way, you should be prepared just in case. By tracking everything and keeping thorough documentation, you can keep peace of mind.

A PPP loan can be a life-saver for a small business, but it's extremely important that it be used the way it is intended and not abused. Ensure that you are using the money the right way to avoid problems down the road.

1. https://www.sba.gov/about-sba/sba-newsroom/press-releases-media-advisories/joint-statement-administrator-jovita-carranza-and-secretary-steven-t-mnuchin-success-paycheck

2. https://www.sba.gov/sites/default/files/2020-05/PPP2%20Data%2005012020.pdf

3. https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program

4. https://www.syracuse.com/back-in-business/2020/05/you-got-a-ppp-loan-now-what-4-expert-tips-from-a-small-businesses-lawyer.html

5. https://www.cnbc.com/2020/04/28/small-business-loans-above-2-million-will-get-full-audit-to-make-sure-theyre-valid-mnuchin-says.html

How AI Can Help Your Business

How AI Can Help Your Business